The Centers for Medicare and Medicaid Services (CMS) has announced significant changes effective October 1, 2024. These changes will impact how agents and brokers work with Medicare Advantage (MA) plans and Prescription Drug (PDP) plans and guide clients through their healthcare options. Here’s a summary of what you need to know.

Prohibition of Certain Contract Terms:

To ensure agents and brokers can serve their clients’ best interests, new regulations prevent Medicare Advantage and Part D organizations from imposing contract terms that could restrict agents’ ability to assess and recommend the most suitable plans. Bottom-line, carriers cannot pay partial commissions on a product.

Unified Compensation Rate:

CMS will introduce a unified compensation rate for all plans, updated annually. This aims to standardize compensation across different plans, simplifying the payment structure for agents and brokers. For some states, this will be an increase in commission and for others, it will not.

Elimination of Separate Administrative Payments:

CMS has decided to eliminate separate payments for administrative services provided by agents and brokers. Now, all forms of compensation will be included under a single revised definition of ‘compensation’, making financial dealings clearer and more straightforward. Look to see HRA’s and marketing reimbursements go away.

Increase in Initial Compensation:

To better cover necessary administrative activities, there will be a one-time $100 increase to the fair market value (FMV) compensation rate for agents and brokers. As previously stated, this change will result in commission increases for certain states, while for others, there will be no change.

Updates Under the Inflation Reduction Act:

The Act brings further changes in 2024 and 2025, including an expansion of the low-income subsidy program and the introduction of a $35 monthly cap on insulin costs. Starting in 2025, there will also be a $2,000 yearly cap on Medicare prescription drug costs, with Medicare beginning to negotiate drug prices directly. Expect to see plans leave the market, formularies decrease, premiums increase and providers having delays in providing services as they navigate this impact in the industry.

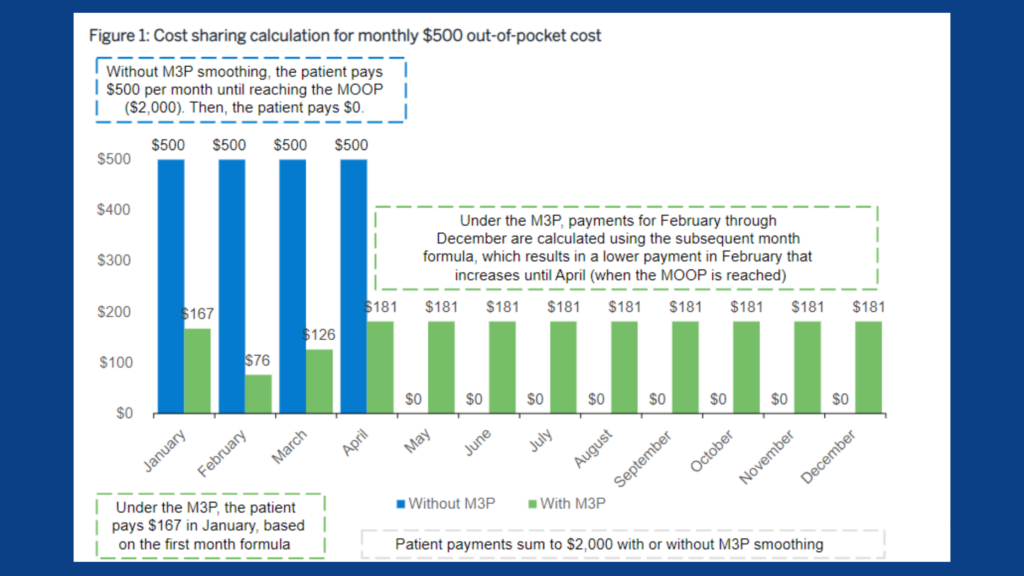

Medicare Prescription Payment Plan:

A new plan will allow Part D enrollees to opt into or out of the program at any time, with an election process that must be completed within 24 hours during the plan year. This plan aims to distribute out-of-pocket costs evenly throughout the year, alleviating sudden financial burdens.

Part D Low Income Subsidy (LIS) Program Expansion:

Geared towards helping Medicare beneficiaries pay for prescription drugs, LIS will be expanded.

Prior to the enactment of the Inflation Reduction Act, Medicare recipients who qualified for LIS received partial benefits if their incomes were between 135% and 150% of the poverty line. Today, any recipient that qualifies for LIS will receive full benefits. These benefits include: no deductibles, no premiums, and $11.20 cap on all brand name drugs covered under LIS ($4.50 for generics drugs). LIS participants will also no longer face a penalty for enrolling in creditable drug coverage late.

Commonly asked Questions & Answers:

- Q: When can Part D enrollees opt into the Medicare Prescription Payment Plan?

- A: Enrollees can opt into the program before the beginning of a plan year or at any time during the year.

- Q: What is the role of pharmacies under the new Medicare Prescription Payment Plan?

- A: Pharmacies will be notified by Part D sponsors if an enrollee’s out-of-pocket costs for a single covered drug exceed $600, triggering a notification about the plan.

- Q: How will Part D enrollees opt into the program?

- A: Opt in directly with their Part D plan sponsor.

- Q: Can those in the Extra Help program participate in the Medicare Prescription Payment Plan?

- A: The Extra Help program is generally more advantageous for those who qualify, but all Part D enrollees, including those in Extra Help, are eligible for the Medicare Prescription Payment Plan

These updates by CMS aim to improve the efficiency and effectiveness of services offering better financial terms and healthcare options for beneficiaries.

We will update our brokers as developments are released. If you have any questions, please contact our agent support at agents@taia.us.