On November 8, 2024, the Centers for Medicare & Medicaid Services (CMS) released the 2025 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2025 Medicare Part D income-related monthly adjustment amounts.

2025 At A Glance:

The standard monthly premium for Medicare Part B enrollees will be $185.00 for 2025, an increase of $10.30 from $174.70 in 2024.

The annual deductible for all Medicare Part B beneficiaries will be $257 in 2025, an increase of $17 from the annual deductible of $240 in 2024.

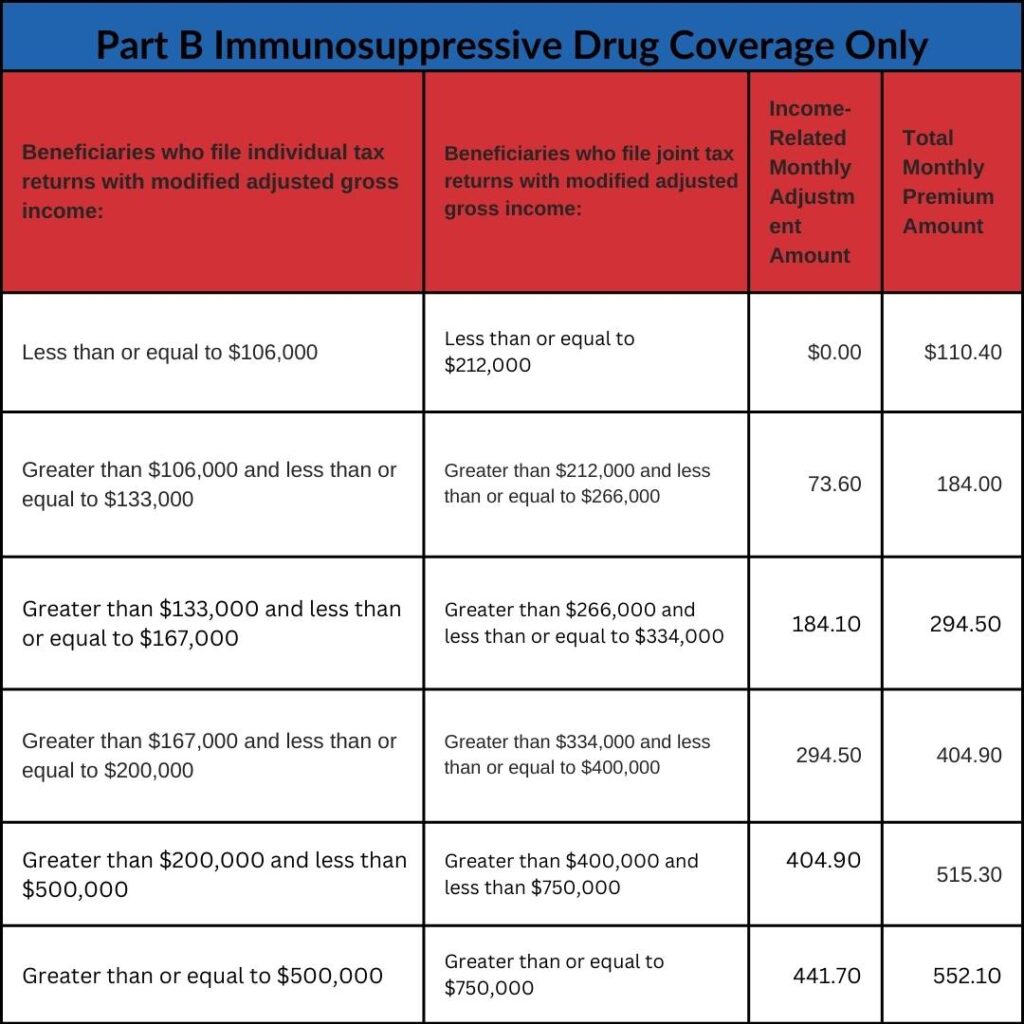

For 2025, the standard immunosuppressive drug premium is $110.40.

The increase in the 2025 Part B standard premium and deductible is mainly due to projected price changes and assumed utilization increases that are consistent with historical experience.

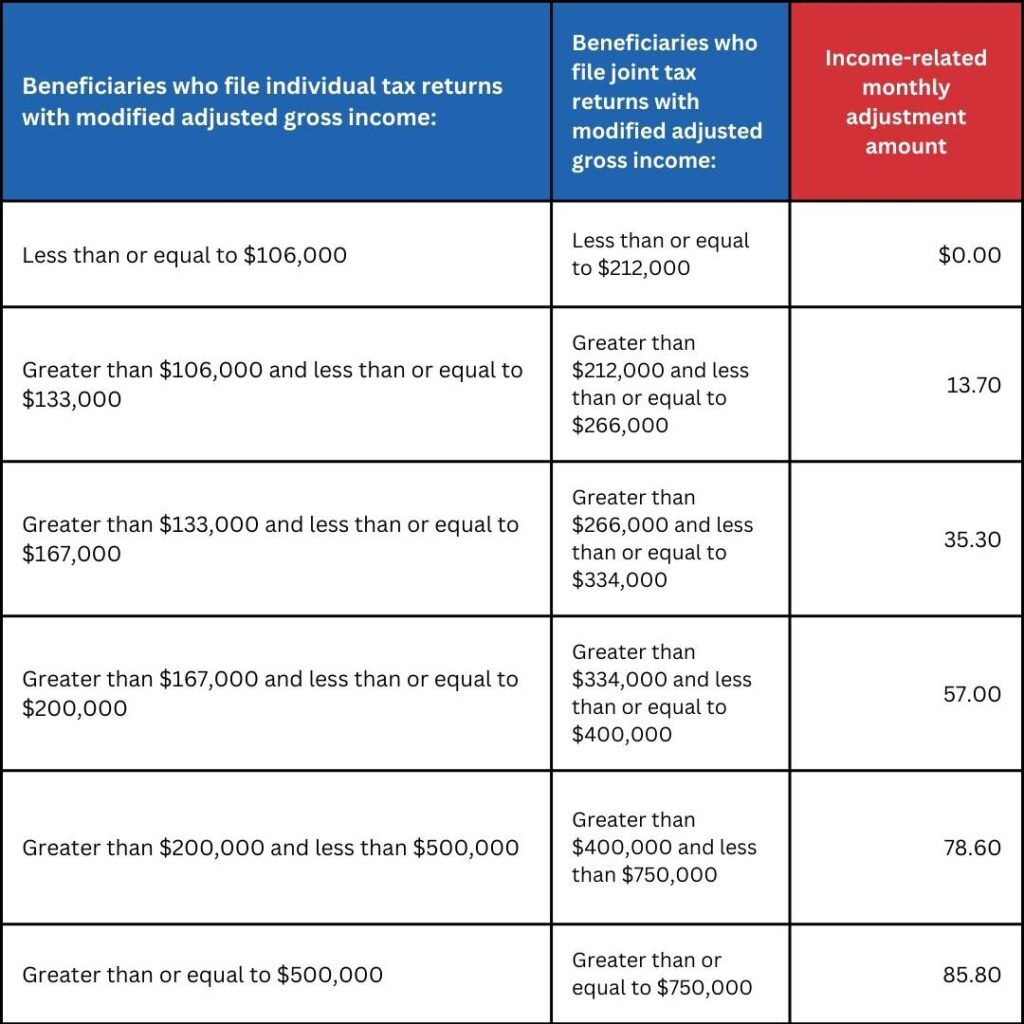

Medicare Part B Income-Related Monthly Adjustment Amounts

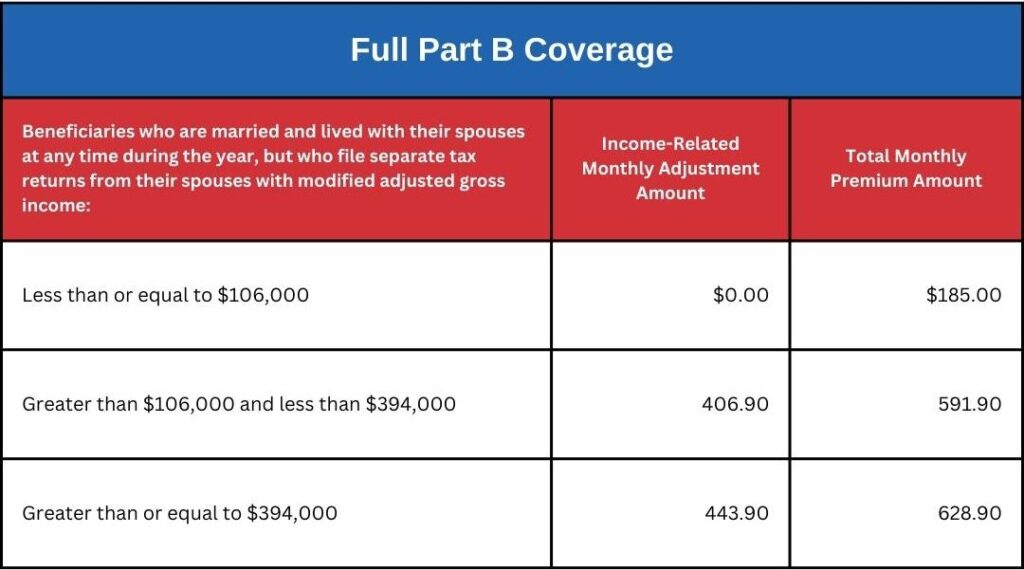

Premiums for high-income beneficiaries with full Part B coverage who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows:

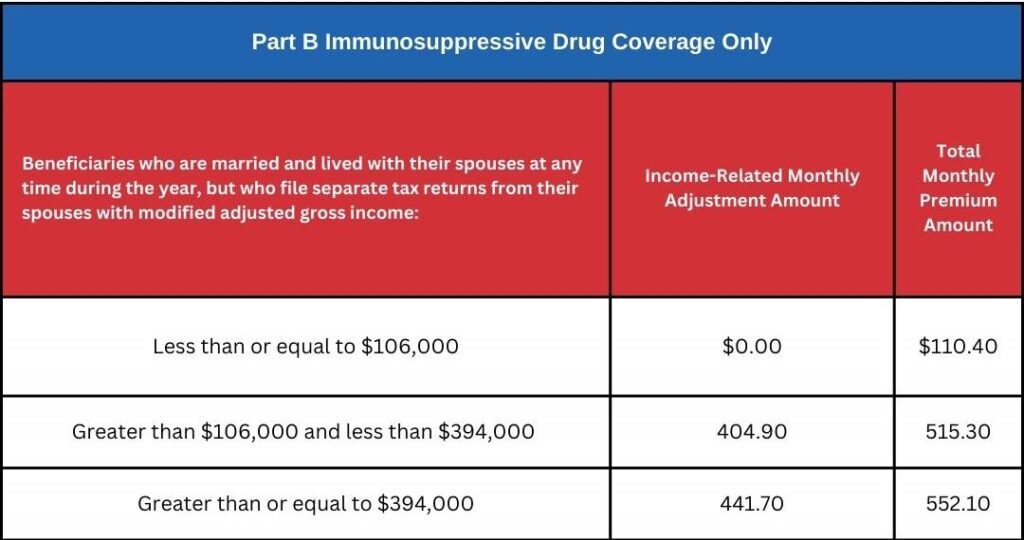

Premiums for high-income beneficiaries with immunosuppressive drug only Part B coverage who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows:

Medicare Part A Premium and Deductible

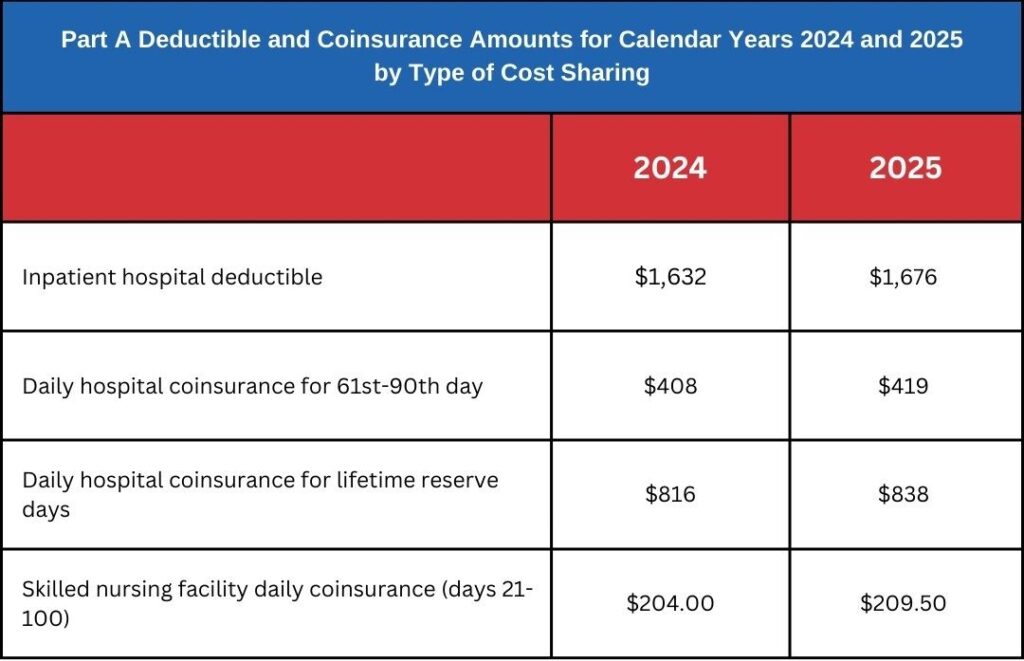

The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,676 in 2025, an increase of $44 from $1,632 in 2024.

In 2025, beneficiaries must pay a coinsurance amount of $419 per day for the 61st through 90th day of a hospitalization ($408 in 2024) in a benefit period and $838 per day for lifetime reserve days ($816 in 2024).

For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $209.50 in 2025 ($204.00 in 2024).

Medicare Part D Income-Related Monthly Adjustment Amounts

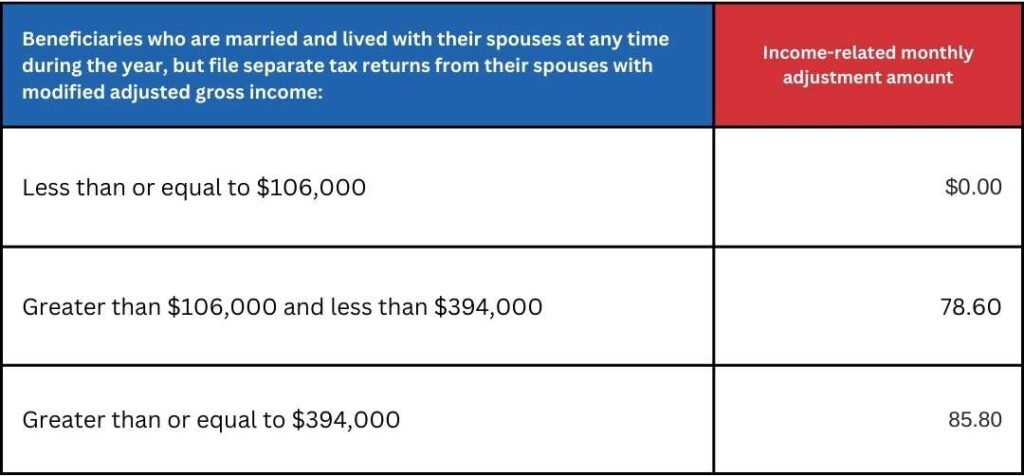

Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows:

If you have questions about these updates, or would like to get information on how to contract with us, email us at agents@taia.us.