On November 14, 2025, CMS released the official 2026 Medicare Part A and Part B premiums, deductibles, and coinsurance amounts, along with updated income-related adjustments for Parts B and D. As you prepare for 2026 conversations with clients, it’s important to understand what’s changing and how it may impact out-of-pocket costs.

Part A: Deductible, Coinsurance, and Premiums

Medicare Part A covers inpatient hospital, skilled nursing facility (SNF), hospice, inpatient rehab, and some home health services. Roughly 99% of beneficiaries still pay no Part A premium because they have at least 40 quarters of Medicare-covered employment.

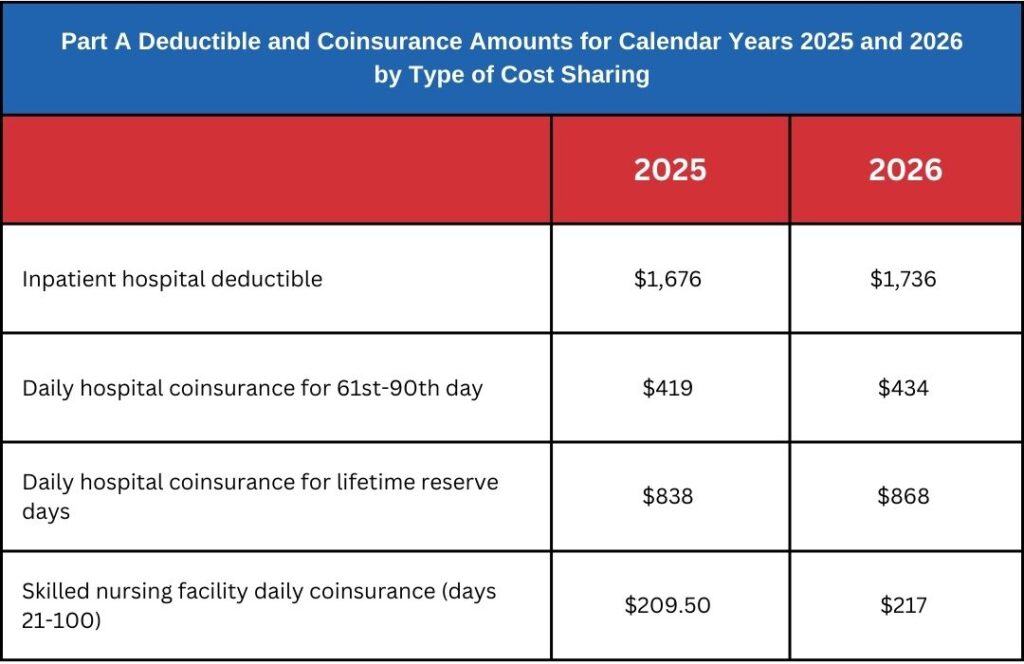

Key 2026 Part A amounts:

- Inpatient hospital deductible:

- 2025: $1,676

- 2026: $1,736 (increase of $60)

- Daily hospital coinsurance:

- Days 61–90: $434 per day in 2026 (up from $419)

- Lifetime reserve days: $868 per day (up from $838)

- Skilled nursing facility coinsurance (days 21–100):

- $217.00 per day in 2026 (up from $209.50)

For clients who do not qualify for premium-free Part A:

- Reduced Part A premium (≥30 quarters of coverage or eligible spouse):

- $311/month in 2026 (up $26 from 2025)

- Full Part A premium (<30 quarters):

- $565/month in 2026 (up $47 from 2025)

These increases are modest but important to factor into conversations around Medigap, retiree coverage, and budgeting for hospital or SNF stays.

Part B: Premiums, Deductible, and High-Income Adjustments

Medicare Part B covers physician services, outpatient care, certain home health, DME, and other outpatient benefits. For 2026:

- Standard Part B premium:

- 2025: $185.00

- 2026: $202.90 (increase of $17.90)

- Annual Part B deductible:

- 2025: $257

- 2026: $283 (increase of $26)

CMS attributes the premium/deductible increase mainly to projected price changes and utilization consistent with historical trends. If CMS had not acted to rein in spending on skin substitutes via the 2026 Physician Fee Schedule, the Part B premium increase would have been about $11 higher per month, so brokers may want to be ready to explain that the increase could have been worse.

For individuals who enroll only in Part B immunosuppressive drug coverage after a kidney transplant, the standard premium will be $121.60 in 2026.

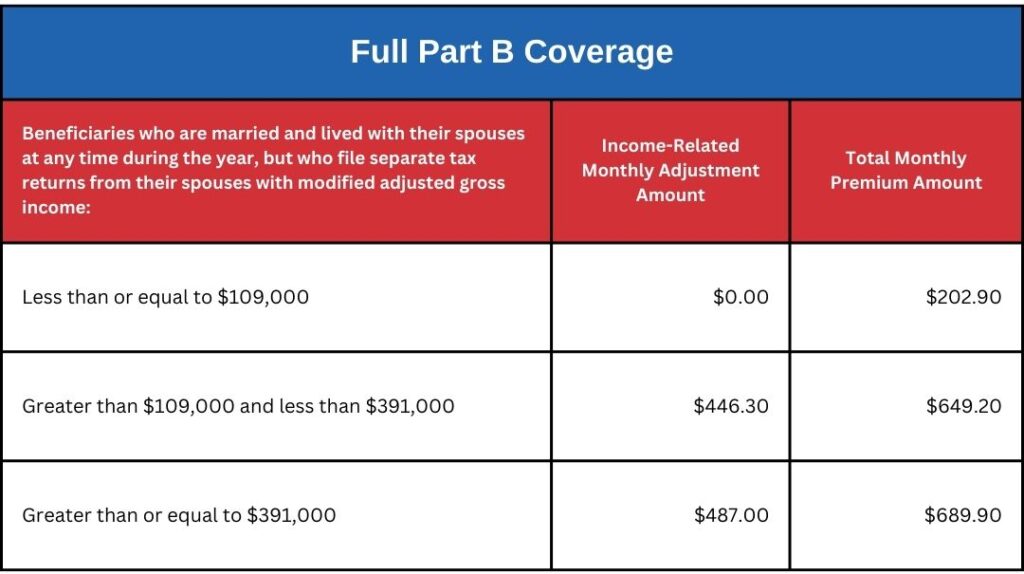

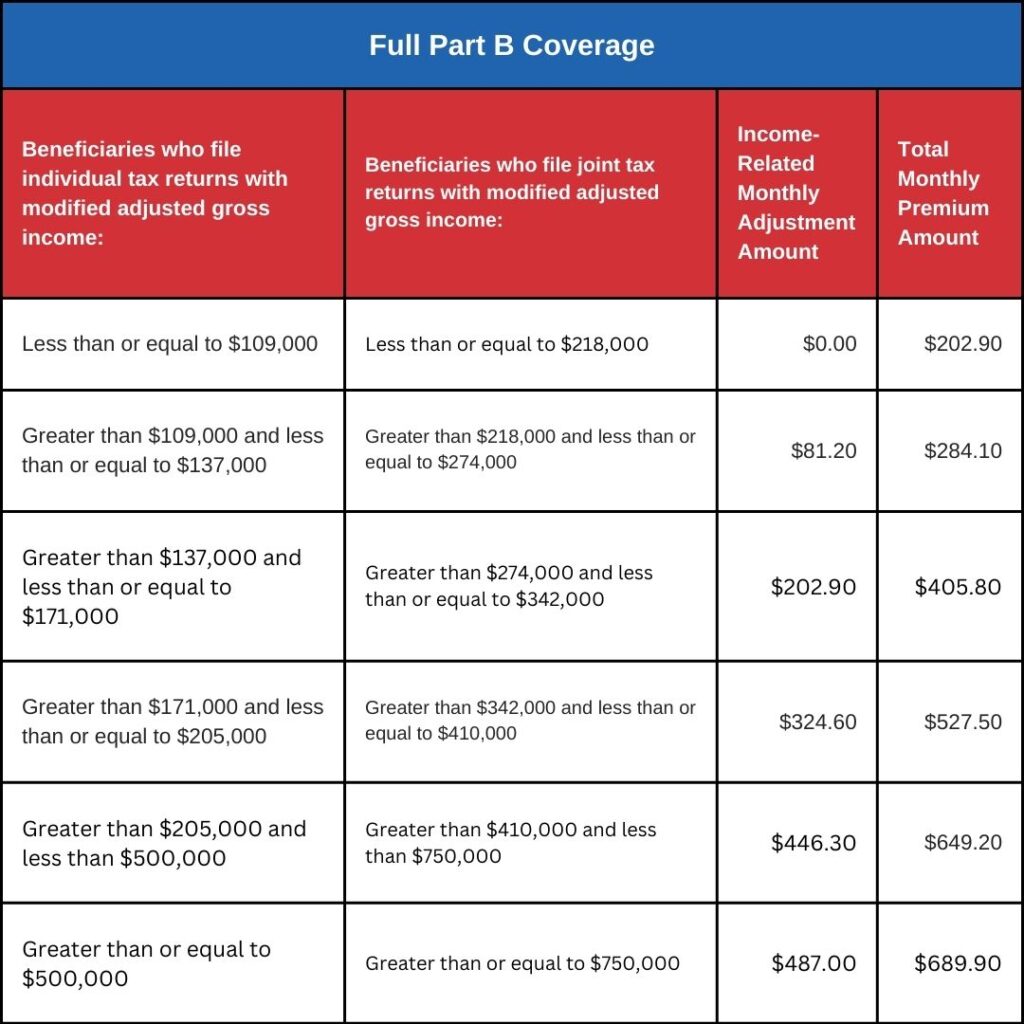

Part B IRMAA: High-Income Beneficiaries

As in prior years, higher-income beneficiaries will pay Income-Related Monthly Adjustment Amounts (IRMAA) on top of the standard Part B premium. Roughly 8% of people with Part B are subject to IRMAA.

For 2026, examples for full Part B coverage include:

- MAGI ≤ $109,000 (individual) / ≤ $218,000 (joint):

- Total monthly premium: $202.90

- MAGI > $109,000–$137,000 (individual) / > $218,000–$274,000 (joint):

- IRMAA: $81.20

- Total monthly premium: $284.10

- MAGI > $205,000–< $500,000 (individual) / > $410,000–< $750,000 (joint):

- IRMAA: $446.30

- Total monthly premium: $649.20

…and higher tiers above that, including separate rules for married filing separately.

There are parallel IRMAA tables for Part B immunosuppressive coverage only and for Part D premiums, where IRMAA is paid in addition to the plan’s base premium.

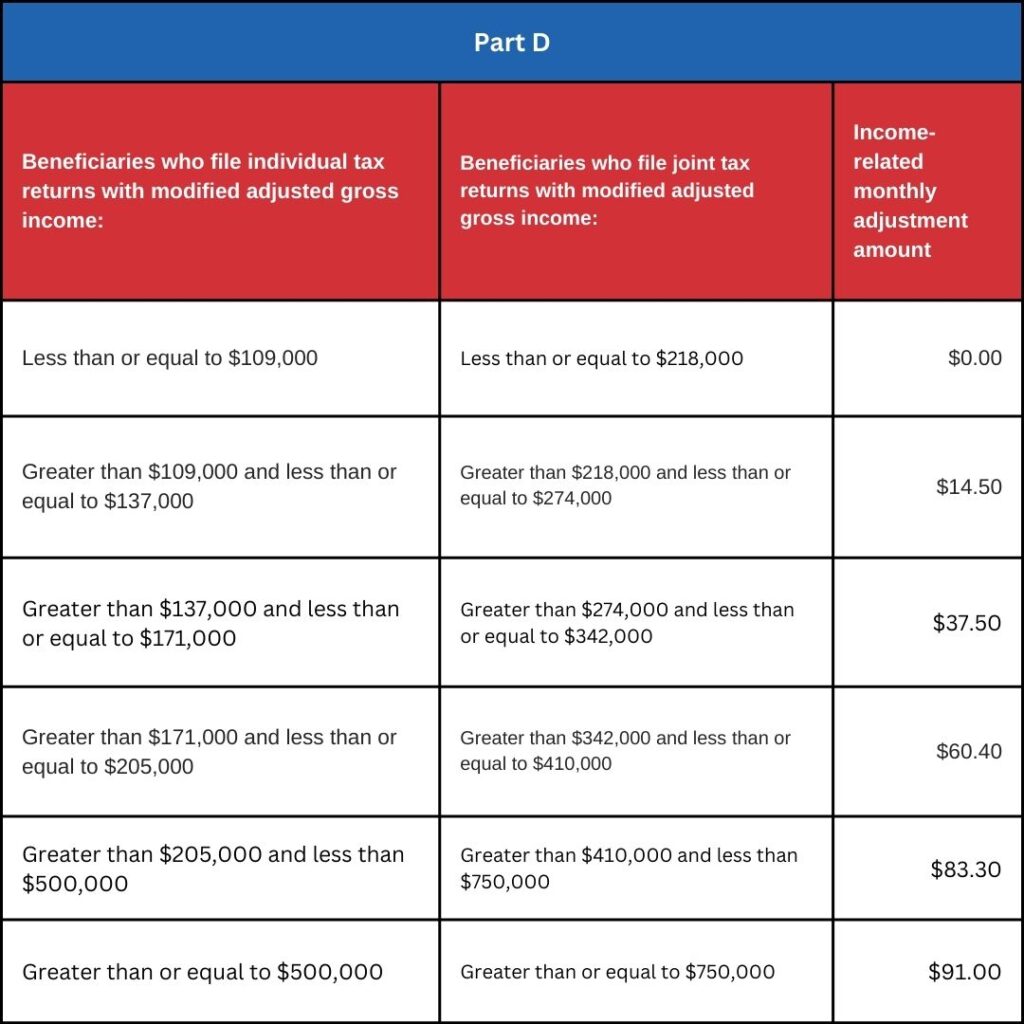

Part D IRMAA Highlights

Part D IRMAA applies to about 8% of Part D enrollees and is paid in addition to whatever the plan charges.

For 2026, examples of monthly IRMAA surcharges include:

- MAGI > $109,000–$137,000 (individual) / > $218,000–$274,000 (joint): $14.50

- MAGI > $171,000–$205,000 (individual) / > $342,000–$410,000 (joint): $60.40

- MAGI ≥ $500,000 (individual) / ≥ $750,000 (joint): $91.00

These amounts are either deducted from Social Security checks or billed directly to the beneficiary, regardless of how they pay their plan premium.

What This Means for Your 2026 Client Conversations

As a broker, you’ll want to:

- Update your 2026 cost comparison tools and client-facing materials with the new Part A/B amounts.

- Proactively explain why clients may see higher premiums and deductibles, particularly for Part B.

- Review high-income clients’ situations for IRMAA exposure and help them understand how it affects total monthly costs across Parts B and D.

- Integrate these numbers into your discussions around Medigap, MAPD, budgeting, and income planning.

As always, your value is in translating these CMS numbers into clear expectations and smart plan choices for your clients.