Key Takeaways for Brokers

The Centers for Medicare & Medicaid Services (CMS) has released the Medicare Final Rule for 2025, which includes significant changes that will impact Dual Eligible Special Needs Plans (D-SNPs). Brokers should be aware of these updates to better assist clients, especially those who are dual eligibles (individuals qualifying for both Medicare and Medicaid). Understanding these changes is critical as they alter both enrollment rules and plan coordination for this group.

What You Need to Know: 2025 Final Rule D-SNP Changes

Navigating the integration of Medicare and Medicaid can be complex, but CMS is aiming to make the process smoother for both brokers and beneficiaries. These changes are designed to improve care coordination, accessibility, and affordability for dual eligibles.

Key Changes Coming in 2025

- Enrollment Limits for D-SNPs:

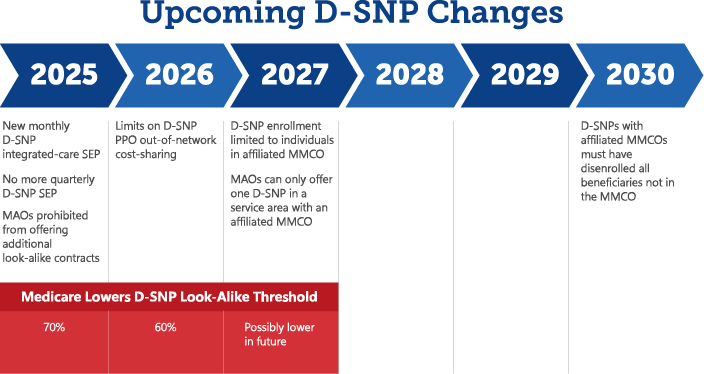

- Beginning in 2027, CMS will restrict enrollment into certain D-SNPs to individuals enrolled in affiliated Medicaid Managed Care Organizations (MMCOs).

- By 2030, D-SNPs must disenroll individuals not enrolled in their affiliated MMCO.

- New Integrated D-SNP Monthly SEP:

- Effective January 1, 2025, CMS will implement a new monthly Special Enrollment Period (SEP) specifically for dual eligibles who enroll in integrated plans. This SEP replaces the current quarterly SEP for stand-alone Part D plans.

- Note: This applies only to states offering integrated D-SNPs. Some clients may not have access to this new SEP depending on state regulations.

- Limits on PPO D-SNP Out-of-Network Cost-Sharing:

- Starting in 2026, CMS will cap the cost-sharing for out-of-network care for dually eligible enrollees in PPO D-SNPs, reducing the financial burden on beneficiaries.

CMS 2025 Final Rule D-SNP Changes Timeline

D-SNP Enrollment Limits: What to Expect

Starting in 2027

CMS will restrict enrollment in certain D-SNP plans to individuals who are already enrolled in or in the process of enrolling in the affiliated Medicaid managed care organization (MMCO). This ensures better care coordination but may limit flexibility for clients.

For example, a dual-eligible individual who is enrolled in one MMCO cannot switch to a different D-SNP unless they enroll in the corresponding MMCO. By 2030, D-SNPs must disenroll any dually eligible individuals who are not enrolled in the affiliated MMCO.

Broker Tip: Be sure to review the Medicaid Managed Care plans available in your area to ensure your clients are properly aligned for D-SNP enrollment. States may impose additional limits, so understanding your local regulations is crucial.

How the New D-SNP Monthly SEP Affects Enrollment

Starting in 2025, dually eligible beneficiaries will have a monthly SEP to enroll in integrated D-SNPs. However, these monthly enrollments are restricted to integrated plans with affiliated MMCOs, so clients cannot switch freely between any D-SNP plans as they once could.

This new SEP will provide more opportunities for clients to enroll in fully integrated plans, enhancing care coordination and simplifying access to services. However, for clients in non-integrated plans or in states without these options, enrollment opportunities will be limited.

Changes to SEPs Key Takeaways:

Effective January 1, 2025, CMS is splitting the current Part D quarterly SEP for dually eligible and other Part D low-income subsidy (LIS) enrollees into two separate SEPs:

- A revised monthly SEP to enroll in a stand-alone prescription drug plan (PDP).

- A new monthly integrated-care SEP to allow dually eligible individuals to enroll into an integrated D-SNP plan when the individual also receives Medicaid services through an affiliated managed care plan.

Broker Insight: It’s important to confirm the level of integration between a client’s Medicaid and D-SNP plans before making enrollment recommendations. Be prepared to adjust your strategy for clients in states with limited Medicaid switching options.

2025 & 2026 Changes to D-SNP Look-Alike Plans

CMS is working to phase out D-SNP look-alike plans, which often market to dual eligibles without offering true integration or care coordination.

- The look-alike threshold will drop from 80% to 70% for the 2025 plan year, and to 60% for 2026.

- MAOs will no longer be allowed to offer look-alike plans starting in 2025, pushing carriers to transition enrollees into true D-SNPs or other MA plans.

Action Item for Brokers: Ensure your portfolio includes fully integrated D-SNPs to meet your clients’ needs as CMS eliminates look-alike plans.

Action Item for Brokers: Ensure your portfolio includes fully integrated D-SNPs to meet your clients’ needs as CMS eliminates look-alike plans.

Implications for Brokers: What to Do Next

These changes present both opportunities and challenges for brokers, particularly in how you approach your dual-eligible clients. Here are some strategies to navigate the new landscape:

- Be Informed About State-Specific Rules

Each state handles Medicaid and D-SNP rules differently. Make sure you are familiar with the regulations in your state (or states you are licensed in) to ensure you’re providing the right guidance for your clients. - Prioritize Thorough Fact Finding

It’s now more important than ever to thoroughly understand your clients’ situations. Ensure you know their Medicaid status and the specific enrollment windows they can utilize. Consider using a fact-finding tool to streamline these conversations and avoid sensitive topics early in the discussion. Consider using a fact-finding tool like CMS Marx or through Carrier Medicare/Medicaid Eligibility lookup tools on their Agent websites to streamline these conversations and avoid sensitive topics early in the discussion. - Expand Your Portfolio

Ensure you are offering integrated D-SNPs from carriers with affiliated MMCOs. These plans will be increasingly important as non-integrated options are reduced. - Check in with Dually Eligible Clients

Now is the ideal time to review the plans your dually eligible clients are currently enrolled in and make appropriate recommendations. Pay special attention to clients in non-integrated plans or look-alike options. It’s essential to inform those in look-alikes that their coverage might change in the fall due to new regulations. Use our A3 platform to export a list of your DSNP clients with ease. Access our Free Agent Resource Guide by emailing agents@taia.us for tools and resources to assist you with navigating benefits for DSNP clients.

Broker Tip: Consider proactively scheduling appointments with clients in non-integrated plans to discuss integrated options and explain the upcoming changes. This personalized approach will help ensure they are well-informed and prepared for the adjustments to their Medicare coverage in 2025.

This year, you may need to service more D-SNP clients during AEP, particularly if they are unable to utilize the new monthly integrated-care SEP due to the plans available in their area or their state’s Medicaid rules. Don’t wait—reach out to your D-SNP clients now to ensure they have the support and guidance they need for the upcoming changes.

The Bottom Line

The CMS 2025 Medicare Final Rule will significantly impact how dual-eligible beneficiaries access care and how brokers help them navigate these changes. From new SEPs to enrollment limitations, the landscape for D-SNPs is shifting, but with the right knowledge, brokers can continue to provide valuable guidance to their clients.

At TAIA, we’re dedicated to supporting our agents, especially during this upcoming AEP. With the changes in the Medicare landscape causing various challenges, we are committed to keeping you informed and updated. while offering back-office support, sales tools, and resources to our valued agents. Our team is here to assist with any questions or concerns you may have.

Please contact us at agents@taia.us if you have any questions.

Not affiliated with or endorsed by Medicare or any government agency.