A Quick Guide for Brokers to Help Clients Choose Wisely

Navigating the intricacies of health maintenance organization (HMO) and preferred provider organization (PPO) plans is no small feat, especially when your goal is to guide clients toward the best-fit healthcare solution. In this blog, we will identify the core distinctions between HMOs and PPOs, offering you valuable insights to empower your beneficiaries in making informed decisions. As you embark on the journey of simplifying these plans, consider this your go-to resource, equipped with essential questions that will streamline your conversations and help your clients confidently choose between HMOs and PPOs.

HMO vs. PPO: An Overview

HMOs are recognized for their cost-effectiveness and provider networks, while PPOs offer greater flexibility at a higher cost, allowing for out-of-network care. Choosing between the two depends on what your clients prefer in terms of costs and restrictions.

HMO stands for “Health Maintenance Organization.”

An HMO plan is typically made up of an approved network of health care providers. In most cases, any medical care your clients receive will only be covered by their plan if they visit a provider from within the plan network.

If your clients seek medical care outside of the plan’s network, they may have to pay the full cost of the services they receive. One exception is in the event of an emergency.

PPO stands for “Preferred Provider Organization.”

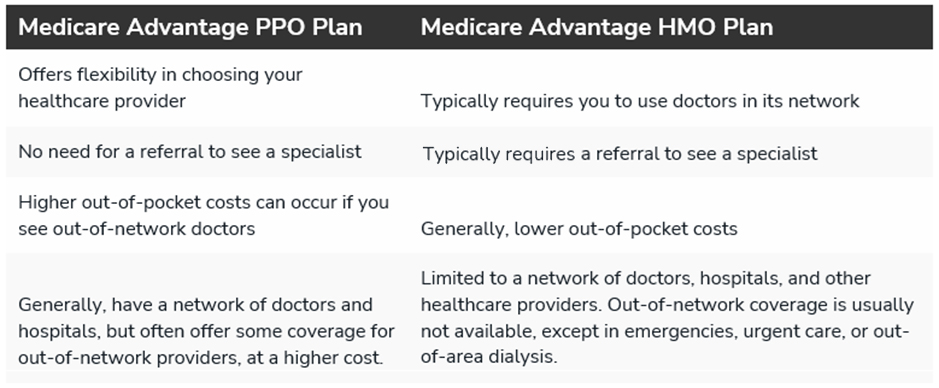

Opting for a Medicare PPO grants your client the flexibility to choose their healthcare provider. Similar to an HMO plan, the PPO plan establishes a provider network, and sticking within this network often results in lower out-of-pocket expenses.

Unlike an HMO plan, a PPO plan may partially cover expenses for care obtained outside its network. However, your client should anticipate higher out-of-pocket costs for care received beyond the designated network.

How are HMO and PPO plans similar?

Despite their differences, HMO and PPO Medicare Advantage plans have a lot in common.

Both types of Medicare Advantage plans provide the same coverage as Medicare Part A (hospital insurance) and Part B (medical insurance) into a unified plan.

Many Medicare HMO and Medicare PPO plans may also include benefits that go beyond what Original Medicare (Parts A & B) covers.

How are HMO and PPO plans different?

Each type of Medicare Advantage plan has its own benefits and choosing between an HMO and a PPO is entirely up to your client’s health care needs and budget. Some might enjoy having a primary care physician. Some people also like the coordinated care they experience in an HMO plan, where the providers in the network take more of a team approach to their care. Other people may enjoy the freedom and flexibility that comes along with a PPO plan.

When choosing the best Medicare Advantage plan structure for you, make sure to consider your provider preferences, financial situation, and medical needs.

10 Key Questions to discuss with your Beneficiary:

Deciding between Medicare health plans can be overwhelming for our beneficiaries. To help streamline the process, we suggest adding these important questions to your toolbox meeting with your beneficiaries who are considering HMO or PPO options:

1. Type of Plan:

- Understand the differences between indemnity (fee-for-service) and managed care (HMO or PPO) plans.

2. Costs of Medical Care:

- Explore premium structures, co-payments, and deductible details.

3. Choice of Doctors:

- Confirm continuity with current healthcare providers and any restrictions on choosing doctors or hospitals.

4. Included Benefits:

- Inquire about coverage for dental, vision, and special services, including prescription coverage.

5. Excluded Benefits:

- Identify services or treatments not covered by the selected plans.

6. Routine Examinations:

- Learn how the plan covers routine check-ups and preventive tests.

7. Emergency Room Procedures:

- Understand if contacting a primary doctor before seeking emergency room care is required.

8. Pre-Existing Conditions:

- Inquire about the exclusion period for pre-existing conditions.

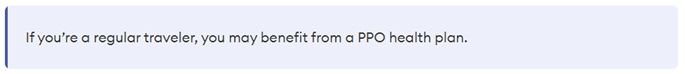

9. Coverage While Traveling:

- Explore how the plan addresses medical costs during travel.

10. Insurer Stability and Claim Disputes: – Assess the financial stability of the insurer and understand the process for resolving claim disputes.

As you navigate the dynamic landscape HMO’s and PPO’s, remember that your expertise as a broker plays a pivotal role in shaping the healthcare journey for your clients. The insights and tips provided here aim to be a guiding light, empowering you to facilitate well-informed decisions. Armed with essential questions and a thorough understanding of the nuances between HMOs and PPOs, you are well-equipped to lead your beneficiaries toward healthcare solutions tailored to their unique needs. Your dedication to their well-being ensures not just coverage but a path to optimal health!

Download our FREE HMO vs. PPO resource HERE

To learn more about how you can support your clients in choosing their Medicare Advantage healthcare plan, contact our client support services at info@taia.us.

Resources:

Medicare.gov

www.uhc.com/news-articles/medicare-articles/the-difference-between-medicare-hmo-and-ppo-plans