Good news for your Medicare Part D beneficiaries! Starting January 1, 2025, the Medicare Prescription Payment Plan under the Inflation Reduction Act will allow beneficiaries to pay their out-of-pocket Part D costs over the year.

It’s important to understand this program doesn’t reduce the total cost but makes it more manageable by spreading it out over the year. Here’s what you need to know to prepare your clients:

All Medicare Part D prescription drug plans must offer beneficiaries the option to pay for their prescription drugs in capped monthly payments.

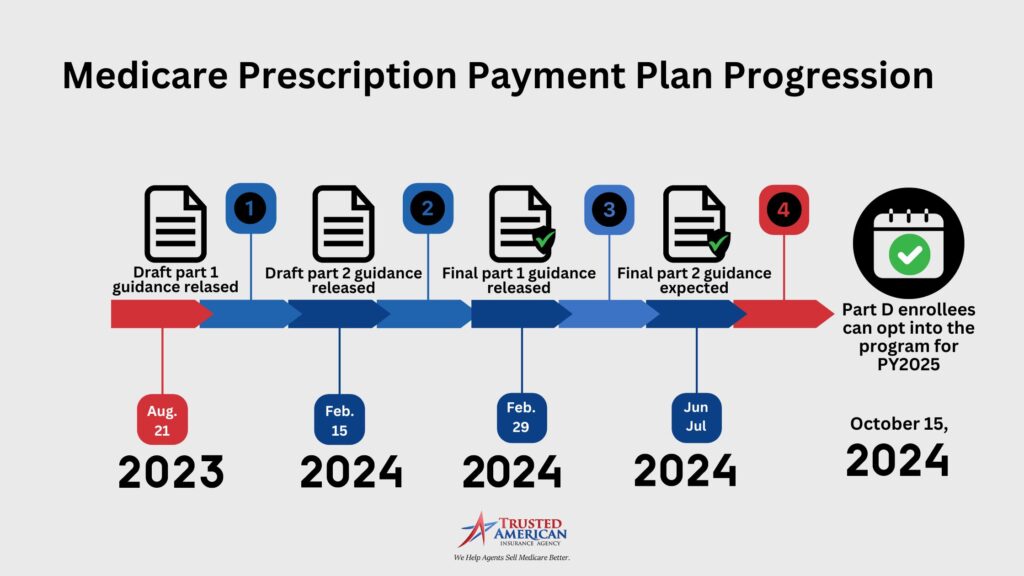

In August 2022, President Biden signed the Inflation Reduction Act of 2022 into law. This law provides financial relief for millions of Medicare beneficiaries by expanding benefits, lowering drug costs, stabilizing prescription drug premiums, and fortifying the Medicare program. Starting in 2025, a new Medicare Prescription Payment Plan will mandate all Medicare Part D prescription drug plans, including stand-alone PDP and Medicare Advantage Prescription Drug (MAPD) plans, to offer beneficiaries the choice to pay for their prescription drugs in monthly payments that are capped.

Who Qualifies?

Anyone with Medicare Part D, including those in the Extra Help program, can qualify. Those with high cost-sharing earlier in the year (such as those paying for brands and non-preferred drugs versus generic) will likely benefit the most.

How to Opt In

Starting in October 2024, during the Annual Enrollment Period (AEP), clients enrolling in Part D coverage can opt into the plan. Clients already enrolled can opt in throughout the plan year by contacting their Part D sponsor.

Make sure you are familiar with this process, so you’ll be able to help your clients opt into the program. No matter if completed by paper, telephone, or online, Part D sponsors must consider all program election requests.

Part D sponsors must process election requests within 10 calendar days prior to the plan year and within 24 hours during the plan year.

Key Details

- The program does not reduce the out-of-pocket cost amount but makes it more manageable.

- Part D sponsors must process election requests promptly.

- Enrollees with high cost-sharing earlier in the year will benefit the most.

The Medicare Prescription Payment Plan offers significant benefits to Medicare Part D beneficiaries by allowing them to spread out their out-of-pocket prescription drug costs over the year. This program provides much-needed financial relief and makes managing healthcare expenses more manageable. It is important for Medicare brokers to stay informed and assist their clients in understanding and taking advantage of this opportunity as it is implemented in 2025.

If you have any questions, or need further guidance on how you can help your clients enroll in this program come October, please don’t hesitate to contact our client support services at agents@taia.us or, 844-709-9835.