As a trusted insurance broker, you play a vital role in helping clients understand their options for managing Medicare payments. This understanding helps clients avoid potential late payments, resulting in possible lapse in coverage, as well as creating financial stress during their retirement years.

This blog will equip you with the knowledge and insights you need to guide your clients through the intricate web of Medicare and Social Security deductions. By helping them grasp the nuances, you can empower your clients to make well-informed decisions, ensuring their golden years are as comfortable as they deserve.

Understanding the Link Between Medicare and Social Security

Medicare and Social Security are two cornerstones of financial stability in retirement. It is crucial for your clients to recognize how they intersect:

1. Automatic Deductions for Medicare Part B Premiums

- If your client is already receiving Social Security benefits, Medicare Part B premiums will automatically be deducted from their monthly Social Security payments.

2. Exploring Deductions for Other Medicare Plans

- Clients with Medicare Advantage (Part C) or Medicare Part D drug plans can request having their premiums deducted from their Social Security benefits. This is NOT automatic, they must request this deduction and set up on their own.

3. Clients Not Drawing Social Security Benefits

- For those enrolled in Medicare but not yet claiming Social Security, they can set up automatic premium payments by setting up Medicare Easy Pay | Medicare. This can be done directly from their checking or savings account. This is the preferred way for a Medicare Beneficiary to pay their bill.

- If you do not get your premiums deducted automatically from your Social Security and decide not to set up Medicare Easy Pay, you will get a bill directly from Medicare: Understanding Your Medicare Premium Bill CMS-500

With Medicare Easy Pay, deductions are on the 20th of the month (or the next business day).

Factors Affecting Deductions

It’s important to inform your clients that the amount deducted from their Social Security checks for Medicare premiums can vary based on several factors, including their Medicare plan choices and their annual income.

Breaking Down Medicare Part A and Part B Premiums

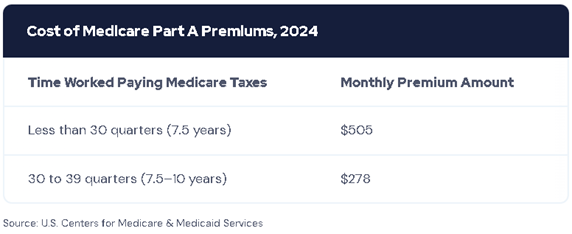

- Most individuals don’t have to pay Medicare Part A premiums, but in certain situations, such as insufficient Medicare tax payments, may require Part A premium payments.

- Medicare Part B premiums, on the other hand, are automatically deducted from Social Security checks.

In 2024, the standard Part B deduction is $174.70, with higher amounts for higher-income clients.

Medicare Advantage and Part D Plans

- Some Medicare Advantage and standalone Medicare Part D drug plans allow for premium deductions from Social Security benefits. However, this process is not automatic and needs to be coordinated with the plan administrator.

Exceptional Cases- What you need to know!

- Qualifying for Social Security benefits can exempt your clients from paying Medicare Part A premiums when they turn 65. However, they will still be responsible for deductibles and co-pays.

- Medigap plans C and F cover the Part B annual deductibles, but only for clients eligible for Medicare before January 1, 2020.

- Some Medicare Advantage plans may offer “give-back benefits” that cover some of the monthly Part B premium. This is commonly known as a “Part B Rebate.”

Key Takeaways:

- Be proactive in assisting your clients with their Medicare and Social Security concerns. They can contact the Social Security Administration online or by phone for inquiries or appointments, providing them with an extra layer of support.

- By arming yourself with this knowledge and sharing it with your clients, you’ll not only enhance their financial well-being but also strengthen the trust they place in your guidance.

- Understanding the intricate relationship between Medicare and Social Security is key to securing a prosperous and comfortable retirement. Your expertise as a broker is the beacon of hope for your clients as they navigate this complex landscape.