Mark, you have a wealth of experience in the insurance industry, tell us a little bit about how you got started, and how long you’ve been in the industry?

“I got started when I was 19. I was going to college, and my father, who was in the insurance business, suggested I work part-time selling insurance to make some extra money. I got licensed at 18 and started selling life insurance. I started my own company in 1990, and since then, I’ve been expanding, continuing my education and adding products and services, while continuously growing my client base.”

Would you say Life Insurance has become your specialty or have you become more Medicare focused?

“My passion is in my life insurance business, it’s a tougher sale, but there’s a lot of reward in it. However, I’ve been heavily focused on the Medicare business for almost 2 years now, and also find that extremely rewarding. I decided to get aggressive in the past year, aiming to build a larger book of business to support my daughter when she graduates. I plan to leave the business to her and my other 2 daughters so that’s really my motivation on setting the goal of 1,000 cases a year.

I looked at it as $250 each on renewals, which would give me a quarter million dollars a year in renewal commissions. My goal is to do 1,000 a year to start, and I believe once I reach that level, it’ll be easier to maintain.”

That’s a solid plan Mark! It sounds like you’re also focused on cross-selling opportunities?

“Absolutely. I’ve been able to cross-sell other products like annuities and P&C insurance to my Medicare clients, which has been very successful. Last year, because of my current Medicare book of business, I wrote almost $2 million worth of annuity business.”

That’s impressive. It seems like you provide a one-stop shop for your clients.

Tell us a little bit about what marketing you’ve found to be successful for you along your journey?

“I’ve never really focused on traditional marketing for my life insurance business. It’s mostly grown through networking and referrals. I just love meeting people face-to-face, so that’s where I put my energy.

Now, when it comes to Medicare, that’s a different story. It’s the only part of my business where I’ve actually spent money on marketing, such as diner ads, Facebook advertising, and Geo-targeting. However, I’ve found that my most successful strategy has been maintaining my networking efforts through local groups I’m a part of.

I also leverage the TAIA Marketing team to manage my social media platforms. This allows me to consistently educate my followers about the latest Medicare news and provide helpful tips regarding their coverage. I’m actually the President of my networking group, so you could say I’m pretty involved. And because of that, most of the business I get from them is Medicare-related.”

Okay, so the next thing we’d love to ask you is, what are the top 3 benefits you found with working with TAIA as your FMO?

“The Back office support I get from the TAIA team is crucial to me. I rely on them entirely. Without their help, I wouldn’t be able to accomplish what I need to do in my business, and continue to write new business. The most important thing for me is to have a general agency that I can do all my health insurance through. Case management, commissions, and marketing, I get all the support through the TAIA team, without having to worry about compliance issues.

If I didn’t have Rosa and her team, I would be lost. So, for me, having that support is crucial.”

With such a busy schedule, how do you stay on top of industry news?

“Anything that comes from Rosamaria and her team I pay attention to. I have other news outlets I follow, but for industry news I know I can count on Rosa to provide us with the latest and most relevant.”

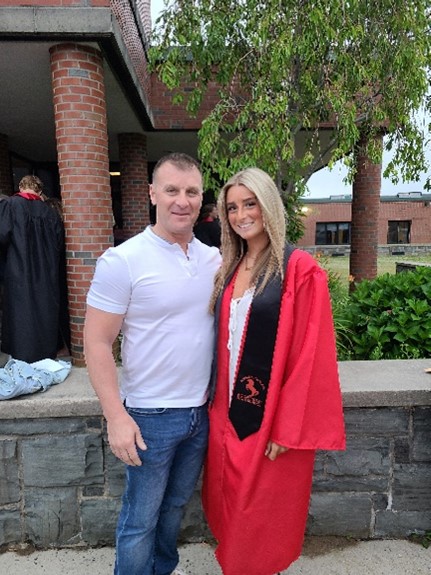

Mark, tell us about your life outside of Medicare and insurance. What are your passions, hobbies, and what keeps you mentally, physically, and emotionally healthy, allowing you to excel in your job?

“Outside of work, staying healthy and fit is my top priority. I hit the gym seven days a week, starting my workouts at 4 a.m. This routine not only keeps me physically fit but also helps me maintain my mental and emotional well-being. Exercise is my way of blowing off steam and staying grounded.

When the weather is nice, I love to play golf. It’s a great way for me to relax and enjoy the outdoors. Additionally, spending time with my children and grandchildren is incredibly important to me.

Aside from my personal interests, I’ve been deeply involved with Easter Seals of New York for almost 17 years, serving as the New York State Chairman. My journey with Easter Seals began after my motorcycle accident where they pretty much wrote me off at the scene. I was in intensive care for 2 weeks, then on to nursing home care facility where I had to relearn how to walk.. I was there for over a month, while my wife was home pregnant with our youngest daughter and raising our other 2 daughters. It was a life changing experience to say the least, but it ignited a passion in me to support others, especially children with disabilities, and I’ve been committed to the cause ever since.

My father, who was also in the insurance business and a manager, taught me something invaluable. He always emphasized the importance of pulling others up with you. In his view, the more people you help succeed alongside you, the greater your own success will be. It’s a lesson that has stuck with me since childhood. I’m truly blessed to be doing what I do in this industry and helping people every day.”

Mark Legaspi, LUTCF, CLTC, Founder & CEO of Imperial Coverage.

Learn more about the Easter Seals Foundation.

TAIA would like to thank Mark for sharing his story and insights with us.

It’s clear that your dedication to your work, your clients, and your community shines through in everything you do. Your commitment to helping others succeed, both in business and in life, is truly inspiring. As you continue to grow your business and support your family, it’s evident that your passion and drive will lead you to even greater success.

We appreciate you Mark, and we look forward to strengthening our partnership with you this year.

Written by,

| Shae Trombatore Marketing Strategist |